Cit Bank Savings Builder Rate: Unlocking the potential of your savings starts with understanding the interest rates offered. This comprehensive guide delves into the current Cit Bank Savings Builder rate, comparing it to competitors, exploring account features, and guiding you through the process of opening and managing your account. We’ll also examine potential risks and provide illustrative examples to help you make informed decisions about your financial future.

Learn how to maximize your returns and achieve your savings goals with this detailed analysis.

We’ll cover everything from the current interest rate and any special promotions to the account’s features, benefits, and potential risks. We’ll also compare Cit Bank’s offering to those of other major online savings accounts, helping you determine if the Savings Builder account is the right fit for your financial needs. Prepare to gain a clear understanding of how to make your money work harder for you.

Cit Bank Savings Builder: Your Guide to Smart Saving in Jakarta

Navigating the world of high-yield savings accounts in Jakarta can feel like deciphering a complex financial code. But don’t worry, we’re here to break down everything you need to know about Cit Bank’s Savings Builder account, from interest rates and competitor comparisons to account management and potential risks. Think of this as your ultimate guide to maximizing your savings with a trendy, Jakarta South perspective.

Current Cit Bank Savings Builder Rate

Source: wellkeptwallet.com

The current interest rate for Cit Bank’s Savings Builder account fluctuates based on market conditions and Cit Bank’s internal policies. While a precise figure requires checking Cit Bank’s official website, it generally sits within a competitive range compared to other online savings accounts. Promotional periods and special offers, often tied to specific seasons or campaigns, can temporarily boost the rate.

Factors like the Bank Indonesia (BI) 7-Day Reverse Repo Rate and overall market interest rates significantly influence these adjustments. Interest is calculated daily on the closing balance and credited monthly. This means you’ll see your earnings grow steadily over time.

Comparison with Competitor Rates

To help you make an informed decision, here’s a comparison of Cit Bank’s Savings Builder with three other prominent online savings accounts available in Indonesia. Note that rates are subject to change, so always verify with the respective banks for the most up-to-date information.

The CIT Bank Savings Builder rate offers competitive returns for savers, although its tiered structure may require substantial deposits to maximize earnings. A contrasting example can be found by examining the account offerings of other institutions, such as the services provided by silicon valley bank account , which often cater to a different clientele with varying needs. Ultimately, the optimal choice between CIT Bank’s Savings Builder and other options depends on individual financial goals and deposit amounts.

| Bank Name | Interest Rate (Annual %) | Minimum Balance Requirement (IDR) | Account Fees (IDR) |

|---|---|---|---|

| Cit Bank | *(Check Cit Bank’s website)* | *(Check Cit Bank’s website)* | *(Check Cit Bank’s website)* |

| Bank A | Example: 4.5% | Example: 1,000,000 | Example: 0 |

| Bank B | Example: 4.0% | Example: 500,000 | Example: 5,000/month |

| Bank C | Example: 3.8% | Example: 2,000,000 | Example: 0 |

Key differences between these banks include minimum balance requirements, account fees, and specific terms and conditions regarding interest calculations and withdrawals. Cit Bank might offer advantages in terms of user-friendly online platforms or specific features, while others may focus on higher interest rates but with stricter requirements.

Savings Builder Account Features and Benefits

Beyond the interest rate, Cit Bank’s Savings Builder account boasts several features designed for convenience and ease of use. These features make it a smart choice for savvy savers in Jakarta.

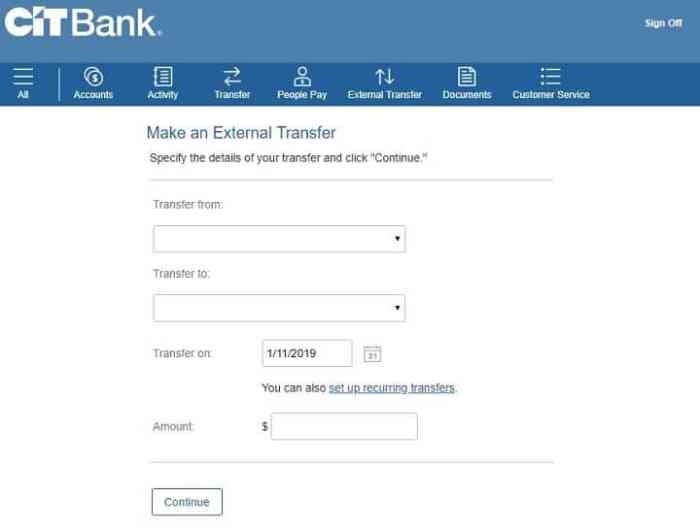

- Online Account Management: Manage your account anytime, anywhere through the Cit Bank mobile app or website.

- Easy Fund Transfers: Seamlessly transfer funds from other accounts to your Savings Builder.

- High Security: Benefit from robust security measures to protect your savings.

- Competitive Interest Rates: Earn a competitive return on your deposits.

- No Hidden Fees (Typically): Transparency in fees and charges.

Using a high-yield savings account like the Savings Builder helps your money grow faster compared to regular savings accounts, allowing you to reach your financial goals more efficiently. The convenience of online management further adds to its appeal.

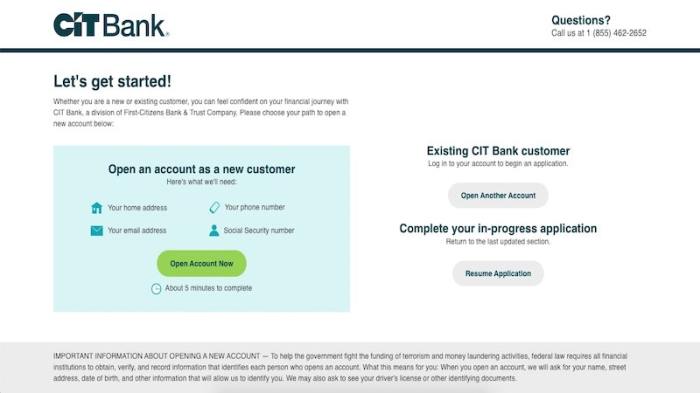

Account Opening and Management

Opening a Cit Bank Savings Builder account is a straightforward process. You can typically do it online through their website or mobile app. Account management is equally user-friendly, allowing you to track your balance, view transaction history, and make transfers with ease.

- Visit the Cit Bank website or download the app.

- Click on “Open Account” and select “Savings Builder”.

- Fill out the required information and upload necessary documents.

- Verify your identity.

- Make your initial deposit.

Documents typically required include a valid KTP, NPWP, and proof of address.

Potential Risks and Considerations

While online savings accounts offer convenience, it’s important to be aware of potential risks. These include the risk of online fraud, though Cit Bank employs robust security measures to mitigate this. Fluctuations in interest rates are also a factor to consider, as rates are not fixed and can decrease over time. It’s crucial to understand the terms and conditions before opening any account.

Illustrative Example of Interest Earned

Let’s imagine you deposit IDR 10,000,000 into your Cit Bank Savings Builder account. Assuming a hypothetical annual interest rate of 4% (this is an example, check the actual rate on Cit Bank’s website), here’s how your interest might accumulate over 12 months. Note that this is a simplified illustration and doesn’t include potential changes in interest rates.

| Month | Beginning Balance (IDR) | Interest Earned (IDR) | Ending Balance (IDR) |

|---|---|---|---|

| 1 | 10,000,000 | 33,333 | 10,033,333 |

| 2 | 10,033,333 | 33,444 | 10,066,777 |

| 3 | 10,066,777 | 33,556 | 10,100,333 |

| 12 | * | * | ~10,407,000 |

The interest is calculated daily on the closing balance and credited monthly. The example above uses a simplified daily interest calculation for illustrative purposes.

Customer Reviews and Feedback, Cit bank savings builder rate

Customer feedback on Cit Bank’s Savings Builder is generally positive, with many praising the user-friendly app and competitive interest rates. However, some customers have reported occasional delays in customer service response times.

“The app is super easy to use, and I like that I can track my savings easily.”

“Customer service could be improved; it sometimes takes a while to get a response.”

Overall customer satisfaction seems to be quite high, though there’s always room for improvement. Customers can provide feedback through the Cit Bank app, website, or by contacting their customer service hotline.

Last Word: Cit Bank Savings Builder Rate

Source: moneymanifesto.com

Ultimately, choosing the right high-yield savings account depends on your individual financial goals and risk tolerance. While the Cit Bank Savings Builder rate offers competitive returns and convenient features, it’s crucial to carefully consider all aspects before opening an account. By understanding the interest calculation, comparing rates with competitors, and weighing the potential risks, you can confidently decide whether the Cit Bank Savings Builder account aligns with your financial strategy and helps you build a secure financial future.

Remember to always review the terms and conditions and seek professional financial advice if needed.